Litix is a platform that supports fundamental analysis of listed companies. Free iPad application allows you to analyze the top 100 most profitable companies listed. Storing complete financial statements, Litix allows a quick and easy searching of related data and its financial comparing.

Rankings view provides you with the information classified by sector, reporting period and each of the available ratios and data points about the top listed companies. Tracking the sources of ratio components provided you will be able to see how the given value has been obtained.

Snapshot presents company’s historical performance measured by each of the 60 financial ratios available. Graphic charts and customized table views enable a user to easily analyze trends by clear visualization. It also gives access to news from main financial portals.

Functionality of watch-list is based on monitoring of new submissions. Litix will notify you each time, a company from your individually set investment portfolio is publishing a financial report, which makes you permanently up to date. You will be able to download and preview it as well as to analyze latest performance instantly.

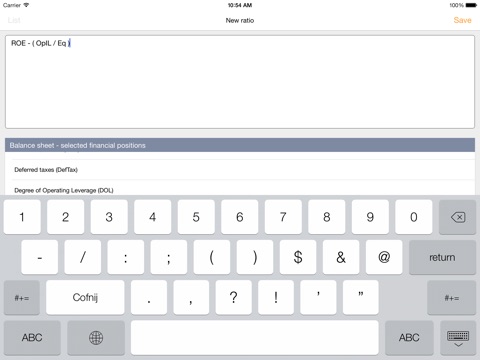

Provided 60 financial ratios are not enough for you to perform complete analysis? No problem, build your own analytical approach by defining your own ratios using “My Ratios” functionality.

List of basic financial ratios and selected financial positions available in Litix.

Balance sheet – selected financial positions ( Accounts payable, Accounts receivable - net current, Assets - current, Assets - non-current, Assets – total, Cash, Cash and cash equivalents and short term investments, Deferred taxes, Equity, Inventory, Liabilities and stockholders’ equity, Liabilities – current, Liabilities - non-current, Liabilities – total, Long-term debt, Marketable securities – current, PPE – net, Preferred dividends, Preferred shares, Receivables current – net, Short-term debt, Total debt)

Income statement - selected financial positions (Cost of goods and services sold, Cost of revenue, Earnings per share – basic, Earnings per share – diluted, Gross profit,Interest income (expense) after provision, Interest payment, Net income (loss), Non-interest income, Operating expenses, Operating income (loss), Profit (loss), Sales revenue – net)

Cash flow - selected financial positions Net cash flows, Net cash flows - continuing operations, Net cash flows - discontinuing operations, Net cash flows - financing activities, Net cash flows - investing activities, Net cash flows - operating activities

Efficiency ratios (Assets turnover, Cash ratio, Current ratio, Debt ratio, Degree of combined leverage, Degree of financial leverage, Degree of operating leverage, Dividend payout ratio, Equity ratio, Financial leverage, Gross margin, Interest coverage ratio, Inventory turnover, Long-term capital ratio, Net margin, Operating margin, Payables turnover ratio, Quick ratio, Receivables turnover, Return on assets, Return on equity, Return on sales, Working capital, Working capital turnover)